-

國內財務簽證及PCAOB財務簽證

真正讓我們與眾不同的是我們服務客戶的經驗,讓正大所能夠在客戶服務上面創造更多的價值

-

稅務簽證

國稅局對於優質會計師事務所出具之報告作書面審核,公司被選案查核機率較低

-

營業稅簽證

本所採用Grant Thornton Voyager 軟體及其他軟體工具等,來提升工作效率

-

公開發行及上市櫃專案輔導與規劃

本所特將會計師與經理群之菁英分成八大部,組成團隊並提供最迅速而完善之專業服務

-

IFRS專區

分享Grant Thornton International之國際財務報導準則專業服務團隊及成員所內專家之寶貴經驗

-

移轉訂價服務

『移轉訂價』是一個全球性的租稅議題。隨著跨國商業活動高速的成長,各國稅局開始注意到稅基是否有在關係人交易中不當的流失,故企業的移轉訂價安排成為關鍵。

-

跨國交易租稅規劃

正大是全球知名會計師聯盟組織Grant Thornton會員,目前約一半的客戶是跨國企業,也因此國際公司在台灣所會遇到的稅務問題,正大所的團隊都已經處理過很多次了。

-

外國專業投資機構之稅務代理人(FINI/FIDI)

外國專業投資機構之稅務代理人(FINI/FIDI)

-

所得稅法第4條,第8條及第25條等專案申請

所得稅法第4條,第8條及第25條等專案申請

-

租稅協定之專案申請

租稅協定之專案申請

-

租稅獎勵申請

租稅獎勵申請

-

稅負平衡政策訂定與假定稅計算

稅負平衡政策訂定與假定稅計算

-

代為計算薪資及各項扣繳

代為計算薪資及各項扣繳

-

資遣通報

資遣通報

-

處理薪資轉帳事宜及繳納扣繳稅款

處理薪資轉帳事宜及繳納扣繳稅款

-

勞保賠償給付申請

勞保賠償給付申請

-

勞健保,二代健保及退休金之申報及繳納

勞健保,二代健保及退休金之申報及繳納

-

年底開立扣繳憑單

年底開立扣繳憑單

-

IT 顧問服務

IT 顧問服務

-

PRIMA 顧問服務

PRIMA 顧問服務

-

營運計劃書編制

營運計劃書編制

-

績效考核服務

正大聯合會計師事務所協助企業進行績效制度建立及優化,創造勞資雙贏的局面。

-

沙賓氏法案第404條遵循查核

沙賓氏法案第404條遵循查核

-

內部稽核服務

內部稽核服務

-

協議程序(併購交易實地查核)

協議程序(併購交易實地查核)

-

風險管理服務

協議程序(併購交易實地查核)

-

舞弊調查服務

舞弊調查服務

-

電腦鑑識服務

電腦鑑識服務

-

外籍人士工作證申請

外籍人士工作證申請

-

商業文件英日文翻譯服務

商業文件英日文翻譯服務

-

公司、分公司、行號設立登記

公司、分公司、行號設立登記

-

外商分公司、辦事處設立登記

外商分公司、辦事處設立登記

-

陸資來台投資設立登記

陸資來台投資設立登記

-

行政救濟

行政救濟

-

企業法律諮詢

企業法律諮詢

-

破產與限制

破產與限制

-

公司解散和清算

公司解散和清算

-

供應商和員工背景調查

供應商和員工背景調查

-

存證信函草稿服務

存證信函草稿服務

-

中英文協議的準備和審查

中英文協議的準備和審查

-

放寬限制出境

放寬限制出境

-

勞動法合規與勞資談判

勞動法合規與勞資談判

-

企業和個人資產規劃

企業和個人資產規劃

-

企業評價服務

Grant Thornton Taiwan的評價團隊提供的評價領域涵蓋企業股權、無形資產、合夥權益、專案計畫等。專業的評價服務得以協助客戶完成合併、收購及出售資產、稅務規劃及法令遵循、財務報導等。

-

ESG 確信報告及相關顧問業務

正大聯合會計師事務所取得了金管會授權辦理 ESG 確信業務(永續報告及溫室氣體)。 目前已經協助許多企業辦理ESG相關業務,如需更多相關資訊,歡迎與我們ESG負責的會計師聯絡。

-

網際網路購物包裝減量會計師確信報告服務

「公司之資本額、實收資本額或中華民國境內營運資金」達1.5億元以上,或自有到店取貨據點數達500以上之網際網路零售業,在包裝減量方面在包裝減量方面,應依平均包裝材減重率或循環箱(袋)使用率規定擇一辦理,且其減量成果須於每年3月31日前經會計師出具確信報告。關於會計師確信報告服務,歡迎跟我們聯絡。

-

其他政府委託專案查核

其他政府委託專案查核

-

財團法人及社團法人等非營利組織(公益慈善基金會)

財團法人及社團法人等非營利組織(公益慈善基金會)

-

文化教育相關產業(私立學校)

文化教育相關產業(私立學校)

Culture, diversity and strategic planning

In light of growing international interest and scrutiny of corporate practices we set out to explore how three major aspects of governance – the role of culture, board composition and strategic planning – are affecting businesses around the world.

Corporate governance: The tone from the top draws on 1,865 telephone interviews with business leaders in 36 countries through our International Business Report (IBR), and 86 in-depth interviews with board directors in eight countries to answer five critical questions in corporate governance today.

1. Whose responsibility is culture?

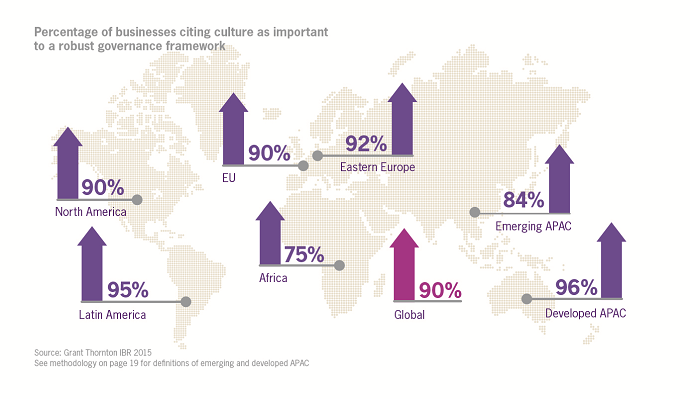

The definition of business culture varies between countries but nine in ten business leaders believe culture is important to a robust governance framework and board members generally agree that it is the board which needs to build and foster this culture. Regulators are also becoming more vocal on the role of culture and expectations for boards. One in five business leaders said that their boards do not spend enough time focusing on culture.

- Boards should work proactively with business management teams to foster a corporate culture of effective governance. While regulators can encourage the importance of culture as the cornerstone of good governance, it can be too intangible to mandate action.

2. How can boards foster a culture of good governance?

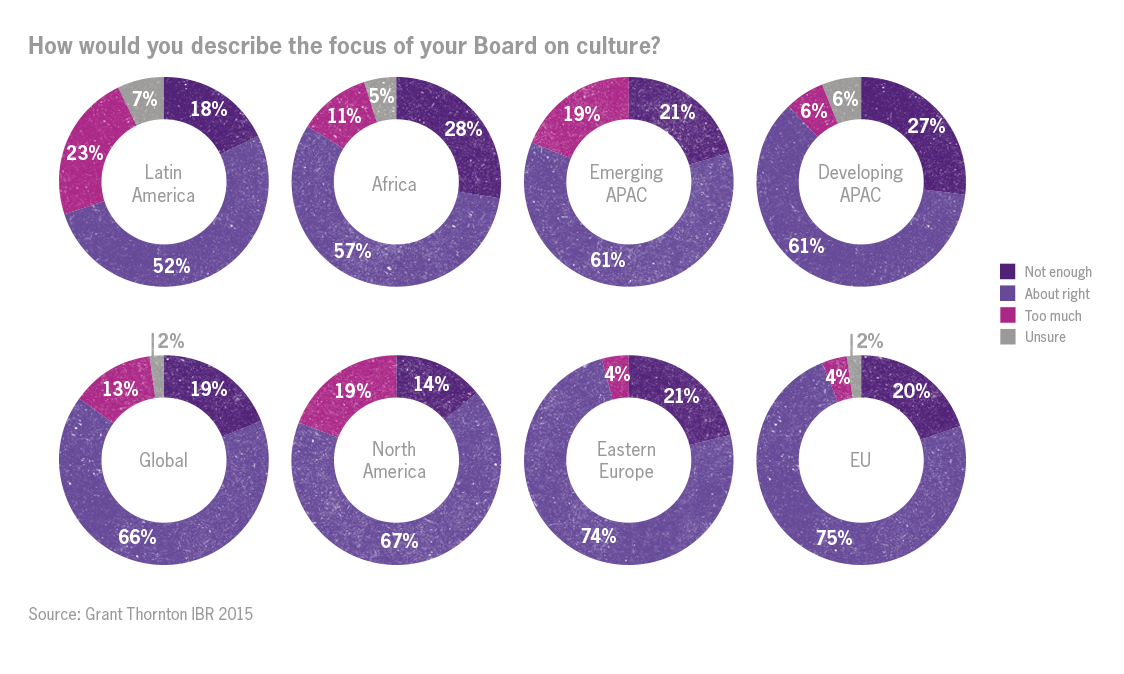

A good governance culture directs how a company behaves, shaping the signature behaviours which bring corporate codes of conduct to life. There is no standard empirical method of measuring culture, but two-thirds of business leaders around the world believe the amount of time their boards spend looking at the broader issue is 'about right' although some board members indicated that boards focus on culture only in response to compliance issues. Board members also cited integrity and transparency as the principles that should underpin every action a business takes, which might be harder when the company is facing tough challenges.

- Boards should encourage the company to pause and reflect on what its real (or original) purpose is to understand whether some of this has been lost sight of in the pursuit of (short-term) profitability. A good governance culture is critical to a company’s longevity but we found worrying evidence that ‘culture’ does not receive the blanket support that might be expected.

3. What does ‘diversity’ really mean and how can it be encouraged?

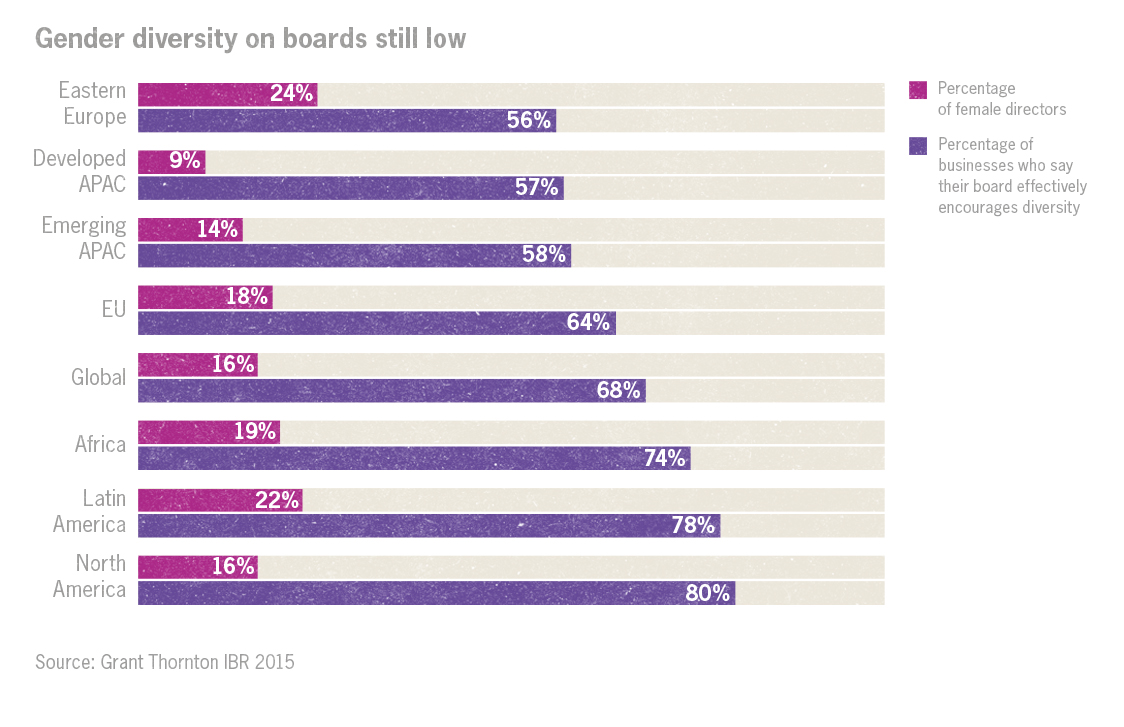

There are many different forms of diversity but two thirds of business leaders surveyed believe their boards are effective in encouraging it (with those in listed businesses more satisfied than their privately held counterparts) but just a sixth of directors globally are women. Board members agree that there is a lack of diversity on boards which makes 'groupthink' a bigger danger. They want to look beyond gender to also seek diversity of culture, background, knowledge and thought.

- Board members should encourage bringing new perspectives onto boards so their businesses can tackle problems from different angles. This creates an open, inclusive mind-set which should cascade down the organisation. Businesses not encouraging diversity risk being left behind in a slow economic recovery.

4. What skills do boards need now and in the future?

Succession planning on boards - to ensure consistency but also to better adapt to new developments in the business environment - has risen up the corporate agenda. Business leaders want their board members to have current industry knowledge, whereas board members themselves indicated more interest in their peers bringing new ideas to the table and having the time available to contribute effectively. A particular concern is technology and whether boards have sufficient current knowledge of the digital space to appropriately advise their management teams.

- Conducting periodic assessments of board skills should form part of a board effectiveness review, along with considering the criteria used for selecting new board members. Relevant experience is an important asset and boards without sufficient knowledge of modern business practices cannot provide sufficient direction to their management teams.

5. Is there a conflict of interest between short-term profits and long-term growth?

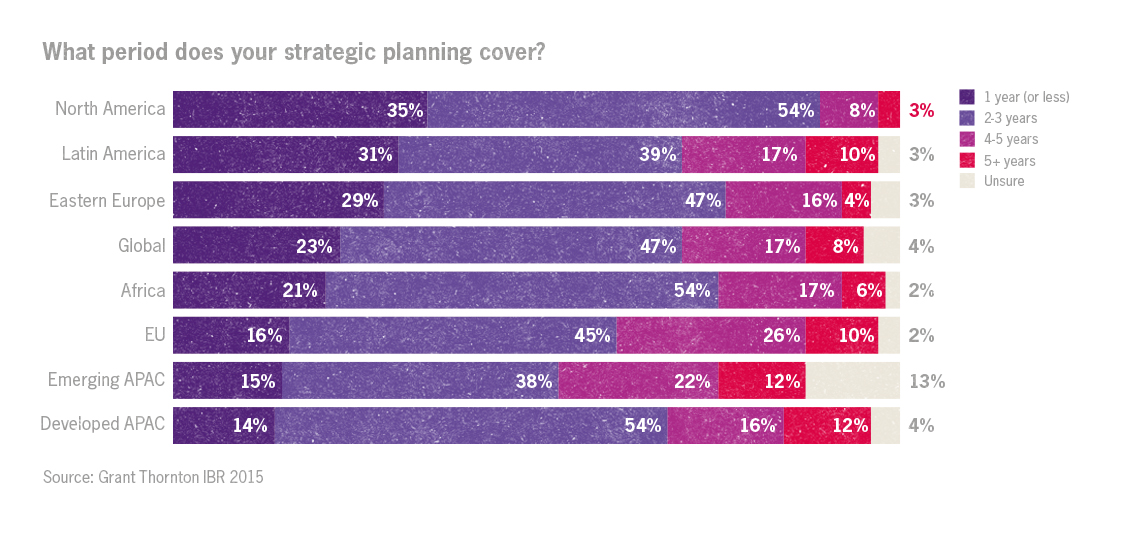

Different industries operate to different planning horizons - for example, mining and utilities need to take a much longer-term view than technology companies - and electoral cycles can also play a significant role. Almost three-quarters of the businesses globally operate under a planning cycle of three years or less. Most board directors believe this is an appropriate planning horizon although some would like to see CEO compensation linked to longer-term performance to avoid operational decisions being driven solely by quarterly reporting.

- Companies need to consider whether their strategic planning process encourages decision's to be made with an appropriate balance of short and long-term objectives, and whether executive management compensation is aligned with the company’s strategic goals.